Scales are fun! Scales are for everything and they can express the most bizarre concepts in a more sophisticated way.

For example, there is the Hot/Crazy scale Barney Stinson made to validate his dates. It is a universal scale, with which you measure your date's feasibility and probability ending up having a Stalker or a burnt car. The video is talking about women, but we definitely believe that this applies to everyone despite sex, age or any other factors.

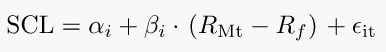

In fxSolver there is no Hot/Crazy line (yet), but there is the Security Characteristic Line. A line formed using regression analysis that summarizes a particular security or portfolio's systematic risk and rate of return. The rate of return is dependent on the standard deviation of the asset's returns and the slope of the characteristic line, which is represented by the asset's beta.

The SCL is plotted on a graph where the Y-axis is the excess return on a security over the risk-free return and the X-axis is the excess return of the market in general. The slope of the SCL is the security’s beta, and the intercept is its alpha. Alpha is a risk-adjusted measure of the so-called active return on an investment. It is the return in excess of the compensation for the risk borne. The beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors.

Go ahead, check this equation and search whatever else you want to solve. You will find some help in our fxSolver video.

Also remember to follow or interact with us in our social media pages. You will find links below.